Preamble While it is difficult to provide a definitive answer without knowing the exact details of investments made in each portfolio, in general, stocks tend to have higher long-term returns but with higher volatility, while bonds tend to have lower returns but with...

Analysis

Advent of DeFi, where is TradFi heading?

There are sometimes revolutions in human activity that do not bear their names. And this seems to be happening with the advent of the complex, nebulous, and sometimes risky world of cryptocurrencies and blockchains. Yes, but here's the thing, cryptocurrencies and...

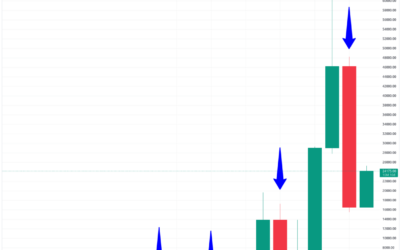

Bitcoin and Its Bullish Phases

Is the bull market upon us? This article echoes the one addressing the topic of BTC and available UTXO, which can be found here. The previous article aimed to highlight that the UTXO indicated that the price of Bitcoin was in a bullish period. Today's article seeks to...

Sharpe Ratio

Bitcoin vs. S&P500: The Sharpe Ratio Investing in financial assets is a crucial decision for any investor, and choosing the right assets can make a significant difference in the final returns. The Sharpe ratio is an effective tool for evaluating the performance of...

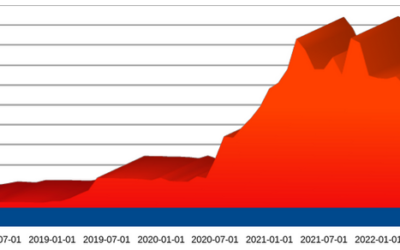

Stablecoin Correlation with Bitcoin Price

No volume, no business As a financial journalist specializing in investment strategies, it is important to analyze the correlation between stablecoins and the price of Bitcoin. Stablecoins are a type of cryptocurrency that is designed to maintain a stable value, often...