No volume, no business

As a financial journalist specializing in investment strategies, it is important to analyze the correlation between stablecoins and the price of Bitcoin. Stablecoins are a type of cryptocurrency that is designed to maintain a stable value, often pegged to a fiat currency like the US dollar.

Without significant trading volume, business opportunities in the market are limited. In other words, understanding how a market functions is crucial, and it’s important to remember the basics. A market is an exchange between a buyer and a seller, and the more participants there are, the more liquid the market is (meaning that instruments change hands quickly).

Stable coin

In order for this exchange to take place, the use of a tool recognized by all market participants is necessary: currency. The world of cryptocurrencies is no exception to this rule, and as an innovative market, new (crypto)currencies have emerged to facilitate market transactions.

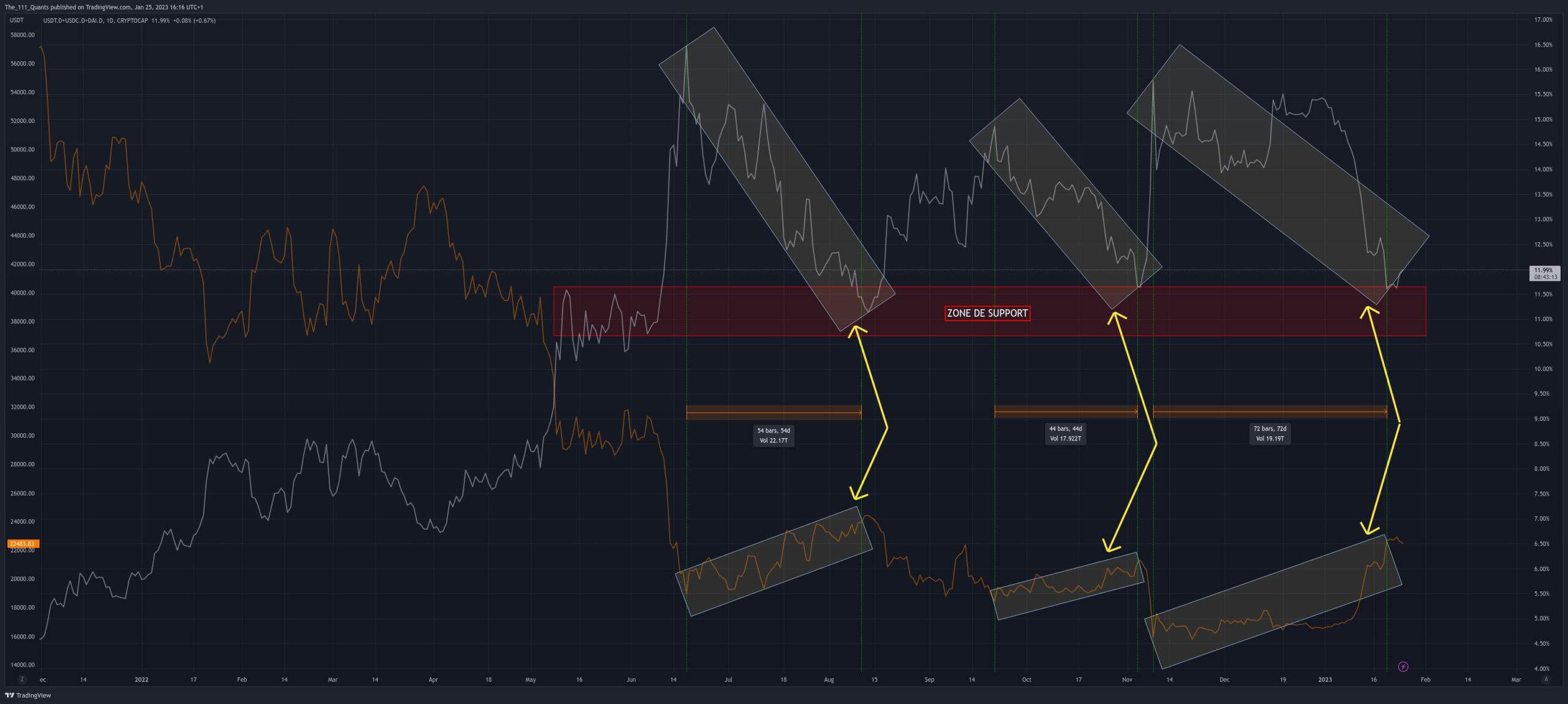

One advantage of stablecoins is that they are also cryptocurrencies, making them easily identifiable and quantifiable. Therefore, their movements can be studied to provide valuable insights. Here is a non-exhaustive list of these stablecoins: USDT, USDC, DAI, BUSD, etc. They all share the characteristic of being pegged at a 1:1 ratio to a fiat currency such as the US dollar ($) or the euro (€), etc.

Importance of Studying Stablecoin Movements

The study of stablecoin movements holds significant value for investors and market participants. Here are a few reasons why it is important to analyze the movements of stablecoins:

-

Market Indicators: Stablecoins, with their 1:1 peg to fiat currencies, provide valuable insights into market sentiment and liquidity. Monitoring their movements can help investors gauge the overall stability and health of the cryptocurrency market.

-

Risk Management: Stablecoins offer a way to mitigate risk in volatile markets. By studying their movements, investors can assess the level of stability and potential risk associated with different cryptocurrency investments.

-

Trading Strategies: Analyzing stablecoin movements can assist in developing effective trading strategies. By understanding how stablecoins interact with other cryptocurrencies, investors can identify potential arbitrage opportunities or timing for entering and exiting positions.

-

Market Efficiency: Stablecoins play a crucial role in facilitating liquidity and transactional efficiency within the cryptocurrency market. Studying their movements helps investors assess market dynamics and identify potential trends or patterns.

-

Regulatory Compliance: Stablecoins have garnered increased attention from regulatory bodies. Monitoring their movements helps investors stay informed about any regulatory developments that may impact the broader cryptocurrency market.

Overall, studying stablecoin movements provides valuable insights into the broader cryptocurrency ecosystem, enabling investors to make informed decisions, manage risks, and capitalize on market opportunities.