Blog

The Monetary Ponzi: The Inevitable Implosion of Fiat Currencies.

Dear friends, Allow me to share something INCREDIBLE with you. What we are currently witnessing is much more than just a phenomenon. It's a clear sign of the imminent collapse of the US dollar and all the fiat currencies that follow. What you are about to read is of...

Crypto-currency investment manual for institutional investors (Canadian market)

Table of contents: 1. Introduction1.1 Purpose of the handbook1.2 Canadian Market Context and Opportunities2. Understanding Cryptocurrencies2.1 What is a cryptocurrency?2.2 Major cryptocurrencies2.3 Blockchain technology3. Canadian Regulatory Framework3.1...

TradFi, DeFi & Flash Loan

Table of contents: I. Comparison between Traditional Finance (TradFi) and Decentralized Finance (DeFi) A. Definition and Overview of TradFi1. History and Development of Traditional Finance2. Roles and Responsibilities of Traditional Financial Institutions3....

Impact of including Bitcoin in a balanced portfolio

Preamble While it is difficult to provide a definitive answer without knowing the exact details of investments made in each portfolio, in general, stocks tend to have higher long-term returns but with higher volatility, while bonds tend to have lower returns but with...

Advent of DeFi, where is TradFi heading?

There are sometimes revolutions in human activity that do not bear their names. And this seems to be happening with the advent of the complex, nebulous, and sometimes risky world of cryptocurrencies and blockchains. Yes, but here's the thing, cryptocurrencies and...

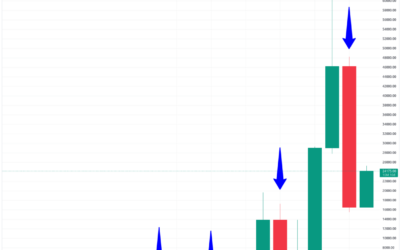

Bitcoin and Its Bullish Phases

Is the bull market upon us? This article echoes the one addressing the topic of BTC and available UTXO, which can be found here. The previous article aimed to highlight that the UTXO indicated that the price of Bitcoin was in a bullish period. Today's article seeks to...

Pattern Trading

Chart pattern trading is a method of trading based on the analysis of graphical patterns that asset prices can form on a chart. This approach involves identifying recurring patterns in the price movements of an asset and making trading decisions based on these...

Derivatives and Bitcoin

Market derivatives data as a short-term trading tool Market derivatives data can be used as a tool for short-term trading. The actions in the market on February 15th (yesterday) provide a good illustration of what happens when buyers and sellers confront each other....

Bitcoin & UTXO

What is UTXO ? La technologie blockchain de Bitcoin repose sur un concept clé appelé UTXO, ou "unspent transaction output" en anglais, qui est essentiel pour la sélection et l'association des entrées et des sorties de transactions pour effectuer des paiements. Les...

Distinction among Canadian investors

Different Categories of Investors In Canada, securities regulations establish a distinction between accredited investors and retail investors, based on their income, net worth, and investment experience. Here is a comparative table outlining the differences between...

Sharpe Ratio

Bitcoin vs. S&P500: The Sharpe Ratio Investing in financial assets is a crucial decision for any investor, and choosing the right assets can make a significant difference in the final returns. The Sharpe ratio is an effective tool for evaluating the performance of...

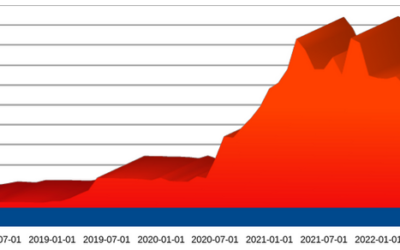

Stablecoin Correlation with Bitcoin Price

No volume, no business As a financial journalist specializing in investment strategies, it is important to analyze the correlation between stablecoins and the price of Bitcoin. Stablecoins are a type of cryptocurrency that is designed to maintain a stable value, often...

News

Current Market Update Central banks have aggressively raised interest rates to combat inflation, with all eyes on the Fed as the US dollar is the world's reserve currency. Although inflation in the United States has started to decrease, the Fed has not backed down....

Contact