There are sometimes revolutions in human activity that do not bear their names. And this seems to be happening with the advent of the complex, nebulous, and sometimes risky world of cryptocurrencies and blockchains.

Yes, but here’s the thing, cryptocurrencies and their (countless) blockchains seem to be here to stay.

Often criticized, announced as “a big joke” or even “dead”, they resist against all odds.

Much to the chagrin of its most vehement detractors, they are gaining more and more momentum, firstly through an ever-growing albeit erratic “market capitalization”, but more importantly, they are conquering the very tangible world of industry through increasingly prestigious partnerships such as luxury brands, prestigious jewelers, banking and financial institutions, academia, or the industrial world.

From all sides, cryptocurrencies and even more so their blockchains are swooping down on the world as the Internet once did, and it seems we are only at the beginning.

It is clear that with an adoption currently estimated at 2-3%, the king of cryptocurrencies has reached a historical peak of $69,000 on the Bitstamp platform.

Many experts regularly predict a valuation exceeding $10 million by 2028, although at the time of writing these lines its valuation is around $21,600.

In any case, we must acknowledge its quality of displaying a brazen return of 299,775% since August 1, 2011.

For comparison, the S&P500 index displayed an honorable return of 227.51% over the same period.

That is to say, a return 1,317.63 times less than that of Bitcoin over the same period.

In this context, managers might be led to wonder about the value of this same Bitcoin when adoption reaches, for example, 50% and the opportunity to put some of it in the “bottom of the basket” especially as the Canadian financial markets authority (AMF) recognizes the appeal of this asset and now devotes a particularly documented section to it. (ici).

Specialization of certain players

The constantly evolving technical characteristics, still nascent industrial issues, as well as team challenges in the world of cryptocurrencies, along with a market in full swing, all pose challenges to the establishment of a sustainable investment strategy for a manager from the traditional finance world (TradFi).

The emergence of on-chain, para-chain analysis tools, and the like, as well as the emergence of innovative communication channels such as Discord, Element, Telegram, which allow projects to communicate directly with their communities, are all new parameters to consider before delving deeper into an investment that can very quickly become risky.

Consequently, some players are starting to specialize in this market by developing real competencies.

202 Asset Management Inc. is among those, and since 2018, it has been operating solely in this market, developing numerous efficient tools and strategies.

What can we expect from such a specialized player?

First and foremost, the philosophy is not to generate excessive returns haphazardly, but to ensure, as far as possible, optimal security for the entrusted funds. Tools and strategies are put in place so that funds are engaged in the markets only when conditions are favorable. Therefore, in most cases, there are few or no positions taken.

This philosophy directly results in optimal returns according to the aforementioned market conditions and gives birth to a new sector focused on this decentralized technology: DeFi (for Decentralized Finance).

Comparison of portfolios from 2018 to 2022

A previous article compared the return between different portfolios, the details of which can be found here. We now propose to compare these portfolios with the active management concept of the CRYPTO202 fund for an equal amount of 100 million and for an equivalent period.

| Stocks (S&P500) 60% Bonds (Universal index) 40% |

Stocks (S&P500) 63% Bonds (Universal index) 37% Bitcoin 5% |

Crypto202 Cryptocurrencies 100% Active management |

|

| initial Investment | 100 000 000 $ | 100 000 000 $ | 100 000 000 $ |

| Average annual return | 6,2% | 17,3% | 51,58% |

| Portfolio value after 5 years and 2 months | 123 150 390 $ | 255 643 435 $ | 759 160 979 $ |

In light of these figures, it seems reasonable to take an interest in the world of cryptocurrencies and their blockchains. The question now seems to be about engaging with the right players to take advantage of substantial potential.

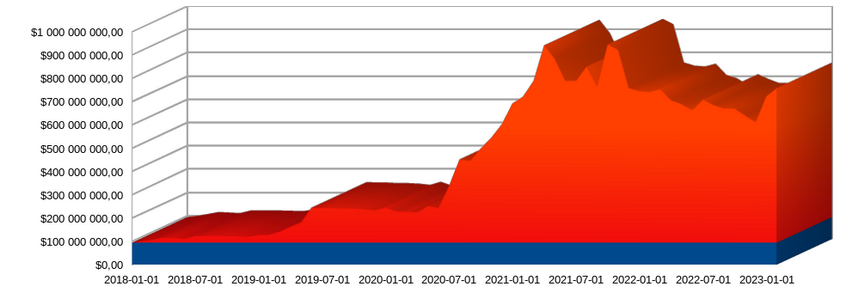

Actively Managed Capital

The active management concept of the CRYPTO202 fund constitutes a major offering in the active management of a 100% cryptocurrency portfolio.

Of course, there are some offers of portfolios invested in cryptocurrencies, but none provide a real solution in terms of active management and risk management.

While most funds invested in cryptocurrencies are subject to the market and its customary volatility, the active management concept of the CRYPTO202 fund helps to mitigate this volatility while optimizing its returns.

To be convinced of this, one only needs to look at the progression curve of the return over the period taken as an example (2018 – February 2023).

Metrics and Ratios

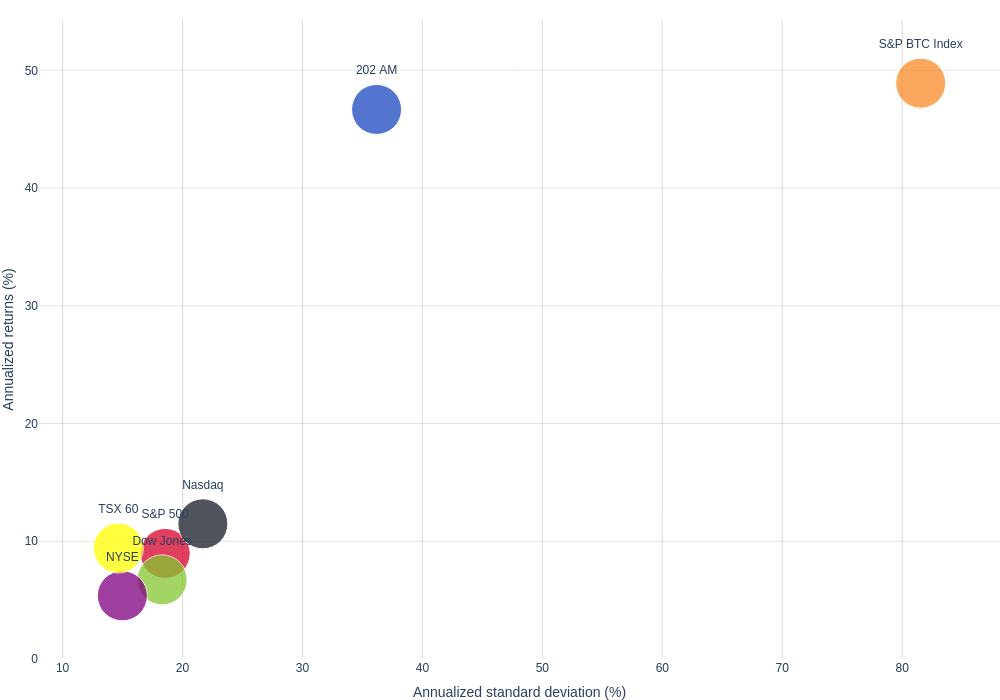

If one needed to be convinced of the value of these assets within one’s portfolio, metrics and ratios could be of great use. Thus, the active management concept of the CRYPTO202 fund displays some of the best metrics and market ratios.

| CRYPTO202 | S&P BTC Index | |

| Maximum return (%) | 896% | 524.40% |

| Final return (%) | 699.12% | 147.82% |

| Volatility (%) | 36.18% | 81.54% |

| Maximum drawdown (%) | -39.39% | -84.16% |

| Maximum loss (%) | 0% | -65.82% |

And finally,

| CRYPTO202 | S&P BTC Index | |

| Sharpe ratio | 1.23 | 0.57 |

| Bêta | 0.264 | |

| Alpha | 0.322 | |

| Correlation | 0.596 |

Finally, it would be entirely appropriate for a manager to compare the risk-adjusted return over the period 2018 – February 2023 of the active management concept of the CRYPTO202 fund with other indices. Considering all the data, it seems particularly opportune to take into account this new asset that cryptocurrencies represent.